octave

-

Posts

3,124 -

Joined

-

Last visited

-

Days Won

22

Content Type

Profiles

Forums

Gallery

Downloads

Blogs

Events

Our Shop

Movies

Books

Posts posted by octave

-

-

They don't have to fly in cash every week.

The article that Red posted specifically says once a week. Money people withdraw does not necessarily end up back at the post office. Some may be spent out of the area and some may be held onto by some people. Of course some may be deposited back at the post office

-

11 minutes ago, onetrack said:

Because the RE systems cannot be relied on to produce full power 100% of the time. Cloudy days and windless days will seriously impact full output.

Big Battery Storage Map of Australia

There are also growing numbers of home batteries with can sell back to the grid. Growing numbers of EVs with the ability take from the grid when power is plentiful and give power when the grid is struggling. Ever-expanding rooftop solar increasing support by battery.

The wholesale price of electricity according to AEMO is falling https://aemo.com.au/newsroom/media-release/east-coast-wholesale-electricity-prices-fall

I could go on

-

1

1

-

-

Onetrack I have previously put the example of the music school I worked at and my wife managed. Huge sums of money coming in every day during the first week of the term. Her sitting there behind the counter at 8PM with few people around. Even if the owner had invested in an expensive safe that doesn't stop someone from coming in and demanding the safe be opened. Why should the owner of this business be compelled to take cash? If people don't like it they can go to a competitor.

Cash handling does take time. Tallying up at the end of the day etc. All the money surely can't stay at the business site. At some time some of it is going to end up in the bank and someone has to take it there.

Yes, cash was the preferred method in the past but bank robberies were also common.

Back when I joined the airforce we were paid in cash. On pay day the duty sergeant and duty corporal would go down to pay section and pick up the unit's pay. They would then spend quite a while working out the breakdown of denominations paid to each person. (getting it wrong was bad). This system changed somewhat in 1984 when there was a huge armed robbery on Holsworthy army base on a payday. After this when the pay was picked up it was accompanied by an armed guard. We were just one unit on the base, this procedure was done for every unit. Eventually, that was scrapped and money went straight into our account.

My understanding is that cash transactions have declined to 13% People are voting with their feet.

By the way, no one has suggested who should pay the $4000 a week for the post office at Cooper Pedy to fly cash in. I think it is a reasonable question.

-

Just now, onetrack said:

My argument is the cost of electronic transaction systems is effectively hidden, because it's absorbed by million of businesses, and simply added to the cost of the goods that I have to buy.

Cash also has hidden costs. Money has to be printed or minted transported and protected. It has to be manually counted it has to be securely stored or transported back to the bank. For an extreme example, the post office in Cooper Pedt, $4000 a week to supply enough cash for those who prefer it.

I am happy for people to use the method that suits them. A business should not be compelled to take cash if it is too onerous. That is fair enough, isn't it?

-

2 minutes ago, red750 said:

And lots of post offices are closing.

True but the most recent figure I can find is that there are around 4200 post offices. This represents a branch network that is phenomenally bigger than any bank has or has ever had. I guess the question is should the government subsidise unprofitable post office branches? Unlike the big banks, I don't think the post office is raking in the billions. By the way, I am not necessarily against the taxpayer subsidizing services.

In the article you linked to it stated that the post office in Cooper Pedy pays $4000 a week to fly in cash. My question is who should pay for that and is it a good use of money when there are more efficient ways?

-

1

1

-

1

1

-

-

25 minutes ago, spacesailor said:

Bank Australia.

Only in Sydney City .

This is increasingly true of several banks.

26 minutes ago, spacesailor said:It will cost more to get there. than any savings.

I have never been inside a branch of my bank and I don't think I ever will. I have absolutely no need to. You can transact at your local post office. To me it is well worth banking with a bank that doesn't do all the things that people complain about. You can't have everything

28 minutes ago, spacesailor said:Online banking only , if not a city dweller .

Then you can lose everything by a mere scam .

The protections around banking online are quite strong. It is pretty safe as long as you take simple precautions such as not sharing your password and using double authentication etc. Successful scams usually involve people being conned into revealing their bank details. Carrying cash or having sums of money in the home poses a risk.

-

2

2

-

-

I do suspect that even the most enthusiastic users of cash still do a lot of digital transactions. One thing I have to do is manage my mother's money as she is in aged care. Having power of attorney I have full authority to transact on her account and she does have a reasonably large sum of money. It does feel like quite a responsibility. I could draw it all out and move to a country with no extradition treaty (I am of course joking). We live in a different state paying her bills would be a little challenging with cash.

I think cash to some degree will be with us for some time although its use is diminishing.

-

1

1

-

-

8 minutes ago, red750 said:

Then they charge you a fee to save them money while they make multi billion dollar profits.

Perhaps you should change banks. This is where I bank https://www.bankaust.com.au/about-us The thing is people like to complain but seldom take control. Owned by the customers who by having an account are shareholders and get to vote on the bank's direction. No executive bonuses.

-

1

1

-

-

Just to reiterate I am not trying to convince anyone to adopt any particular method of payment.

For me, operating cash is just too onerous. Having retired a couple of years ago we are living on our super. This super is not in the local bank but an amount goes into our bank account monthly. There has been much talk on this forum about greedy profit-driven banks. My bank is owned by its customers. I have never paid any fee with this bank. The downside (for some) is that it does not have branches everywhere. I could go down and queue up at the post office but I have better things to do with my time.

This morning we got our weekly delivery of fruit, veggies, and fish. We started getting these deliveries during the early stages of COVID-19 and liked it so much that we have kept it up. We pay for this digitally. I do not imagine they would want to set the driver up to take cash and to carry enough change for every transaction. Because this is a regular arrangement delivery is free.

When I do go to a supermarket I certainly do not want to have to go to a bank.

When we buy petrol we usually use an app which means we don't even have to go to the service station. We started doing this during the worst of covid.

We fly to Adelaide 4 times a year. We always book online after searching for the cheapest and most convenient flight. For our next trip, we thought we would do something different and go by train. This was organized and paid for online. I suppose I could have driven to the nearest station and handed over the cash.

There are items that we want to examine in person but looking at most of my recent purchases we are happy to read and watch online reviews and then use the net to find the best deal. My credit card costs me $50 a year but this is offset by $200 rewards. We have not paid a cent in interest in the last 5 years. Sometimes there is a surcharge but it is miniscule and certainly cheaper than driving to the bank every week.

I cant really see that my life would be better if I drew out money every week.

-

1

1

-

1

1

-

-

Whilst this can be true for some things it is not true for the majority of what I spend. I have paid cash for an aircon install but it has to be understood that they are no doubt giving you a fraction of what they are saving in creative accounting with regards to paying tax.

Day to day most of us are not paying for items like this. I have just been looking through my credit card statement and I can't see anything in this category. Bunnings are not going to give me a discount, the local cafe won't or the supermarket. If I do pay the occasional surcharge from time to time it is no big deal. I pay down my credit card every Friday and review what I have spent so I pay zero interest. My credit card charges a $50 annual fee but I earn points which I use exclusively for Bunnings vouchers ($200 per year)

Again I really don't care what others do, I do what I do because for me it is cheaper and more convenient and aids with accounting.

-

2

2

-

-

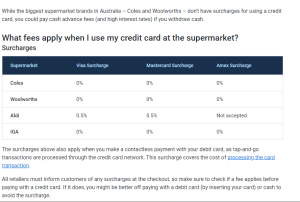

Woolworths IGA and Coles don't have a surcharge but Aldi does (0.5%)

https://www.finder.com.au/how-to-avoid-bank-fees-at-the-supermarket

-

My son just sent me this surprise visitor he filmed Wellington NZ airport about 10 minutes ago.

-

3

3

-

-

1 minute ago, red750 said:

But I think for items less than, say $5, cash is the go.

I am in no way having a go at what others do but at my local coffee shop I use my card even just for one coffee. It does not cost anything extra, it is helpful to them in terms of not having to maintain a cash float and at the end of the week I can check how much I have spent, It works well for me.

-

1 minute ago, red750 said:

I know you'll hate this, but cash is legal tender. Bankns are in business to serve their customers. They rake in billions in profit, surely they can meet their obligations. CommBank just announced a $4 bill + H/Y profit after tax.

Yes I am sure banks make plenty of money and could if they wanted to subsidize marginal branches. At some stage though we will have situations where an armored van will deliver cash for the few who still want it. The post office mentioned in the story you linked to that pays $4000 a week to have cash on hand, who should pay for that? Should the Post office pass that on to all customers?

The fact is that increasingly fewer people want to use cash. I have absolutely no interest in trying to convince anyone to stop using cash. i also believe you should not compel a business to accept cash if it does not work for them. An example I have offered up before in this thread is the music studio I worked in in Canberra. My wife managed the business for the owner. We would get people to pay for the whole term on the first lesson. Back then this was $350. The hours of operation were between 3PM and 8PM. The area was industrial and after 5PM deserted except for music school students. We used to insist on digital payment over the phone or in person. It would have been monumentally stupid to have someone sitting on the desk with several thousand in the till in this area. I think the business was/is both legally and ethically entitled to only accept digital forms of payment even if only for the sake of the safety of the staff.

Again I don't really care how people operate their finances.

-

1

1

-

-

I am happy for people to use cash if they want to however I don't think a business should be compelled to accept cash or that matter a card if they don't want to. I am happy to pay a surcharge to use digital means as long as people who use cash pay the costs associated with that.

17 minutes ago, facthunter said:I don't see that a bank would have to use a Plane to take the cash to Coober Pedy

It was the post office. Any business that deals in cash must ensure that they have sufficient cash on hand and in reasonable denominations. Cash has to come from somewhere and there are costs associated with this.

-

1

1

-

-

Yes, I watched that earlier. Another example of right-wing media propaganda.

-

1

1

-

1

1

-

-

Just now, red750 said:

What about the situation in Victoria.Thousands without power, possibly for weeks. No EFTPOS,no internet. The concept of no cash. Do we all just sit on our hands? Cash is legal tender annd must be available. We seem to be too damned smart for our own good.

The problem is that drawing out cash is also dependent on a power-dependant network. When you draw out money from a supermarket or post office they don't just hand you a wad of cash and write it down in a ledger. Power being out of course does not necessarily stop the transfer of the data required to do business. If I buy a cheeky glass of wine on an airliner it does not require grid power. If I buy something at a country market it does not require power, even the tofu vegan crowd has a wireless EFTPOS device.

Having read the article I have a few questions.

Should a private company be compelled to act as a defacto bank by allowing people to take cash if it is economically disadvantageous?

"Australia Post, for instance, recently revealed it was spending about $4,000 a week to fly cash to Coober Pedy in South Australia to make sure residents had access to cash."

This appears to be incredibly inefficient. My question Red is who should pay for this? I am happy for people to use inefficient cash as long as they are willing to pay the associated costs. I am happy to pay a tiny surcharge to use digital methods.

As for horror stories of people traveling 800km to get cash, who would do that? There are easier ways to handle money.

-

1

1

-

-

18 minutes ago, spacesailor said:

Haven't our" Hearing aid " batteries been " salt ' for many years.

spacesailor

I think most non-rechargeable hearing aid batteries are zinc-air batteries and rechargeable hearing aid batteries are lithium-ion.

-

1

1

-

-

17 minutes ago, spacesailor said:

AND his super disappears each name change .

I don't really understand this. The employer (unless grossly negligent) does not hold your super. I have had the same super fund for over 30 years and I still have this fund. Whenever I changed jobs I elected to keep my super fund. My last employer went out of business but this had no effect on my super fund which is between me and the fund. I am not even sure how a company could withdraw your super, my wife can't even draw out my super (unless I snuff it).

I could see a situation where a grossly negligent company did not deposit your funds or make their co-payments but you would have to be monumentally unaware. I, when working for employers checked my balance regularly.

Indeed, sometimes people who have many short-term jobs and don't take an interest can lose track of some of their accounts. That is why you can for free track down your lost super. I have done this, not because I had actually lost any super but just in the hope that there was ann account that I had overlooked, but sadly no.

-

1

1

-

1

1

-

-

8 minutes ago, old man emu said:

The unit of crude oil production is the "barrel" which contains 160 litres of crude oil. Of that it is usual to produce 75 litres of petrol and 45 of diesel. That's 3/4s of it. The other 1/4 goes elsewhere, like the wide variety of plastics and even things in our food. If EVs took over, there would still be a need for petroleum-based products for vehicles (tyres), or the chemical engineers could develop other useful products. Of course the reduced demand for petroleum fuels would hurt the producers for a few years, but they'd evolve as they have always done and remain profitable.

This is true. We will probably continue to drill for oil for many years to come. As you point out many of the things we use are made from crude oil. Many of the chemicals, drugs, etc that we rely on come from oil. Oil is a remarkably useful substance, so why burn it if we don't have to? The fact is that oil reserves are finite and whether you believe it or not releasing all the CO2 built up over millions of years in a few hundred years is a bad thing.

-

1

1

-

1

1

-

-

BYD breaks ground on its first sodium-ion EV battery plant

Less energy density but a third of the price.

-

1

1

-

1

1

-

-

1 minute ago, spacesailor said:

No handbrake .

When you say it has no handbrake you surely mean it does not have a lever, ratchet, and cable. It does have a handbrake, just not the kind that you are used to. My son lives in Wellington and his driveway is incredibly steep thus far the Tesla hasn't left the premises without a driver.

-

1

1

-

-

1 minute ago, spacesailor said:

The model 3 Tesla I was in ' did NOT ' have a " park lever " .

Only a "park release " button, on the " turn indicator " .

spacesailor

Yep, I can confirm that. I don't see that as a problem though. It is an incredibly easy and pleasant car to drive.

-

1

1

-

-

Electric car thread

in Auto Discussions

Posted

The team from the School of Photovoltaic and Renewable Energy Engineering generated electricity from heat radiated as infrared light, in the same way as the Earth cools by radiating into space at night.

Solar Panels That Work at Night Developed at Stanford